Hi, I’m Burningbird. I love to write. I have a weblog.

Hi, I’m Burningbird

Hi, I’m Burningbird. I love to write. I have a weblog.

People are angry because 8 Democratic Senators voted with Republicans to pass a continuing resolution and re-open the government. The measure now goes to the House where, if Johnson remembers where he left the key to open the doors, it’s likely to pass. Democrats are furious with the Democrats who joined with the Republicans. Oh, […]

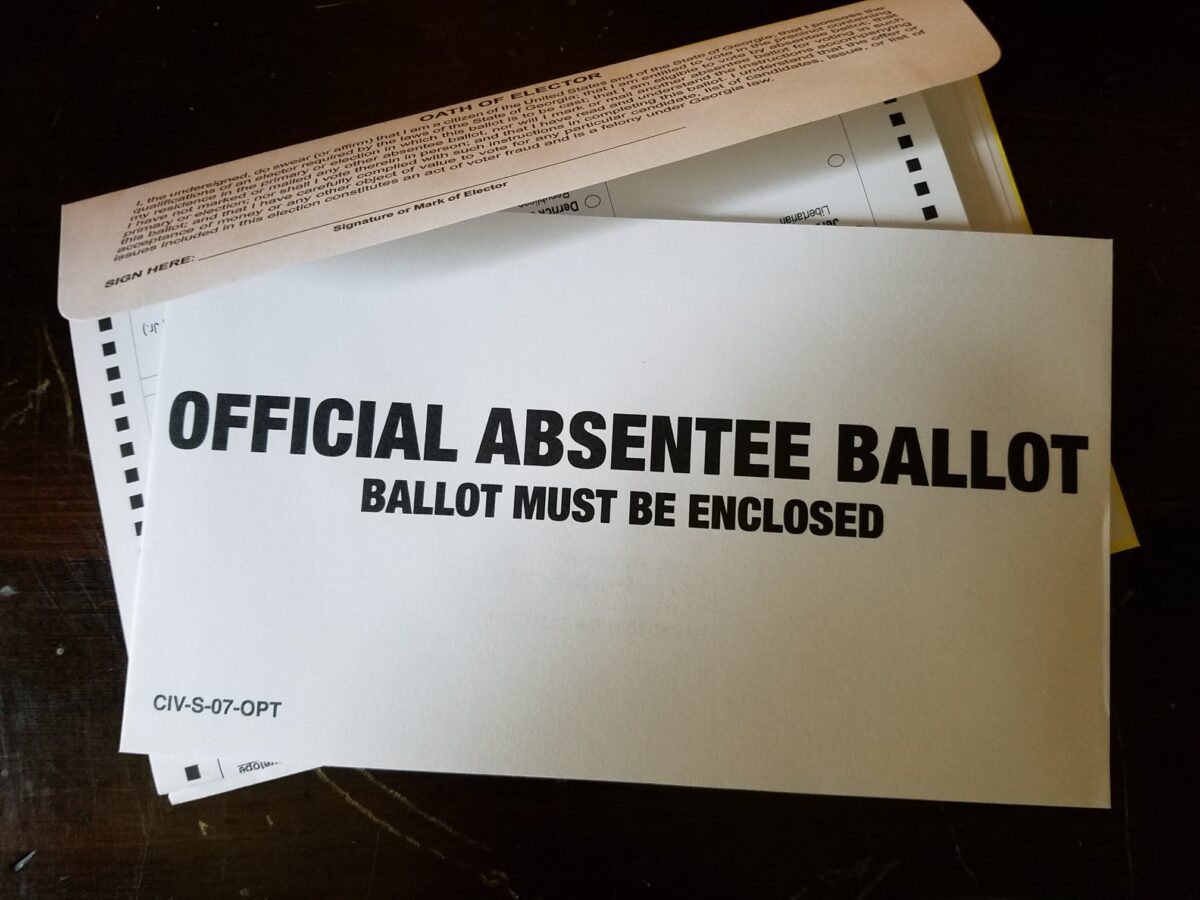

I like to vote absentee ballot when I can. Georgia has no-excuse absentee voting, which means you don’t have a doctor’s permission slip or special circumstances to vote absentee. In past elections, absentee ballots kept us from having to stand in long lines, and also helped keep those lines from being even longer. During COVID, […]

Portland showed us the way in how to fight against the lawlessness that now characterizes ICE and related federal activities: the Portland frog. More specifically, the wearing of inflatable costumes depicting a frog, unicorn, or other whimsical character. Who can forget the image of Kristi Noem on top of the federal building, sternly looking down…at […]

Folks were upset when Illinois State Police showed up at an ICE protest in Chicago. Some questioned why Pritzker would do so. Were the state police now siding with ICE? The answer to why the ISP showed up can be found in federal judge’s ruling about the federalization of Oregon National Guard in Portland. In […]