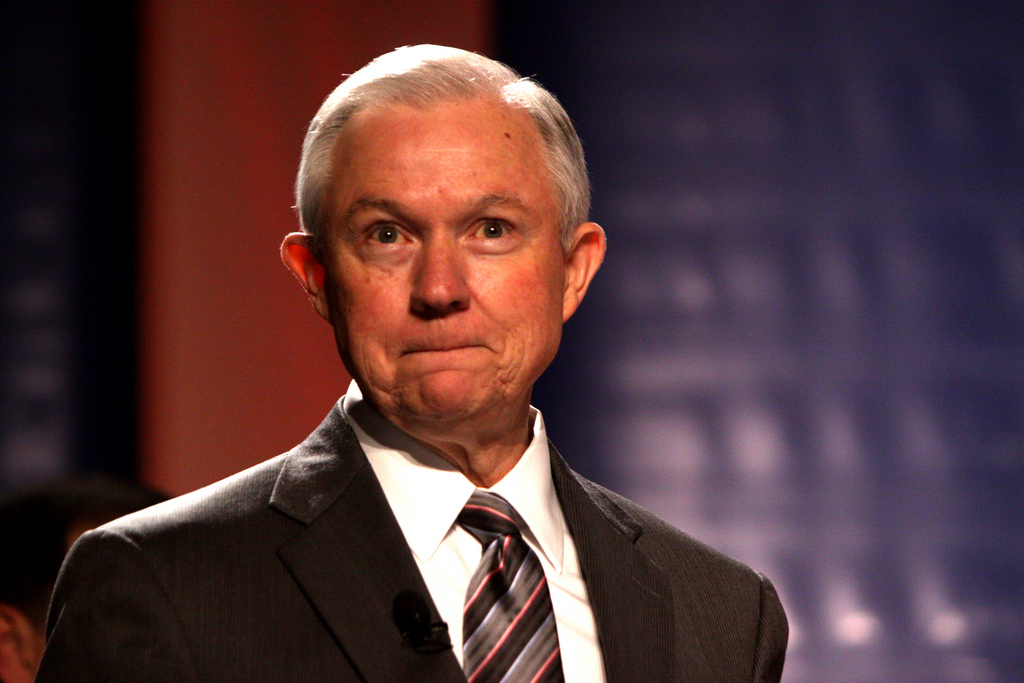

If we were to search for the absolute best leaders for the different cabinet positions in the White House, we’d find Trump’s picks directly opposite them. A cabinet leader should support the mission of his or her cabinet, and seek to ensure it operates to the best of its ability. Trump’s picks have been, almost […]